INSTRUMENTS

Cooper Campbell

Sep 19 - Oct 24, 2021

Presented with Octagon / Moira Sims

Presented as both an exhibition of artworks and as a book that compiles original writing and archival images, Instruments represents Cooper Campbell’s research into the practice of valuation. In tandem with the release of the book, the exhibition takes place at eyes never sleep, an apartment exhibition space on the Upper East Side of Manhattan founded by Colin Ross, an associate director at a gallery on Madison Avenue. The decision to situate Instruments in an art dealer’s home was an intentional one; Campbell has embedded these works within Ross’s domestic space to invoke an appraisal of the art industry’s participants themselves.

The title Instruments is derived from the term’s financial definition: monetary contracts between parties that can be created, traded, modified, and settled. Campbell’s interests in the monetization of art have urged him to examine the art market’s role in the accumulation of wealth. An analogy to alchemy is present in Campbell’s research—what is the definition of value, and how does one issue, institutionalize, or otherwise invent value from raw material alone?

Within the contemporary art world, creating a limited edition of a replicable art object is a widely accepted practice. The sales structure of nineteenth-century French Modernist Auguste Rodin’s artworks set a legal, financial, and cultural model for dispersing the concept of an original work of art, a precedent that remains a fundamental component to today’s art industry. After Rodin’s death in 1917, the French government inherited his intellectual property rights, formed Musée Rodin as a governing body of his estate, and began to posthumously produce Rodin’s sculptures in editions of twelve. By implementing traditional casting and scaling methods to replicate the same object in multiples, it became possible to profit numerous times from the sale of what was, in essence, the same artwork. Mid-century financiers were particularly passionate about collecting Rodin’s works, and Campbell’s essay illuminates unmistakable parallels between Rodin’s market structure and the world of securities trading. In tracing this contour, Campbell finds both markets to be realms impacted, commingled, and determined behind the scenes by the influence of singular individuals and private third parties.

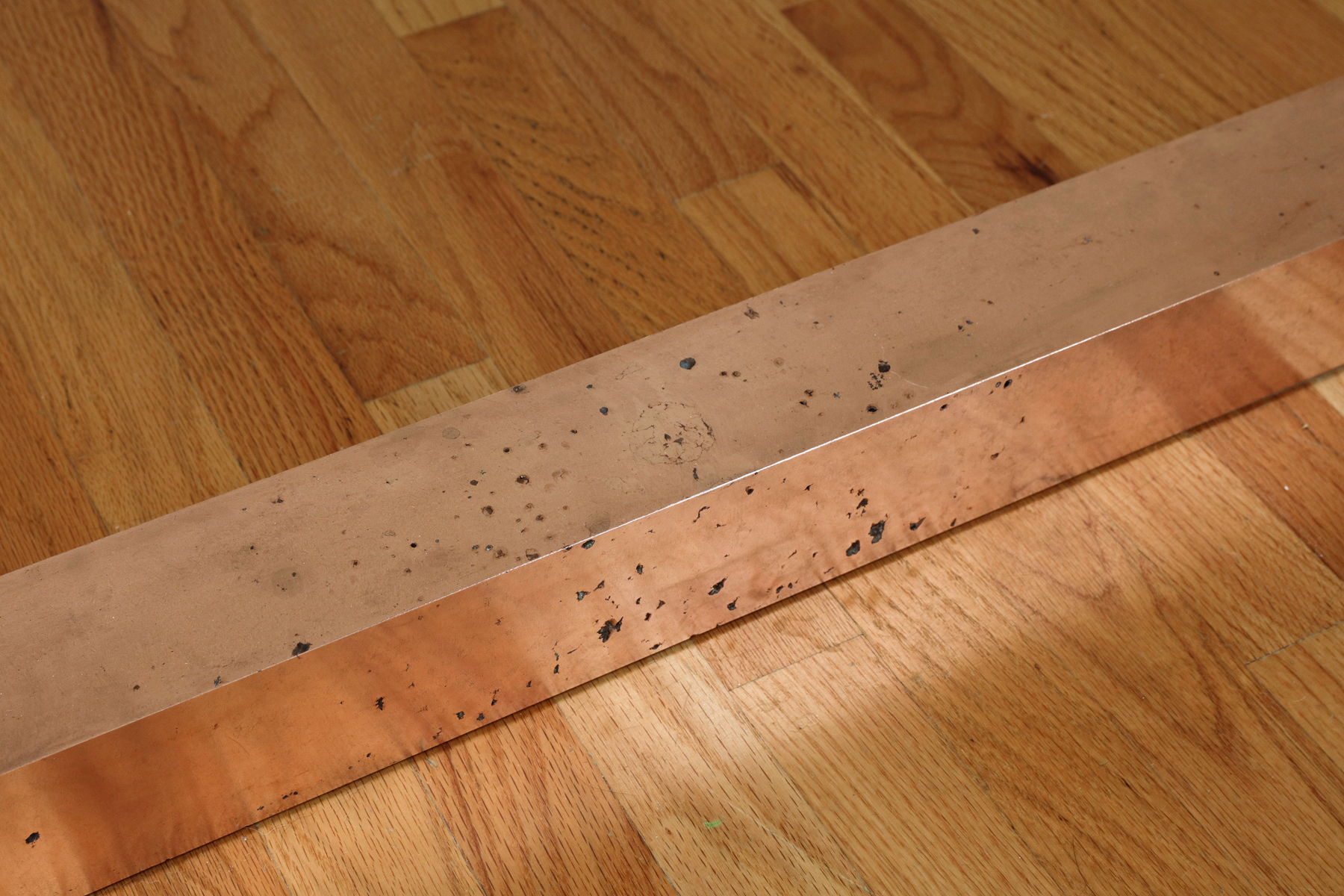

To illustrate the phenomenon of valuation, Campbell has rendered disparate financial devices as his own artworks. Collectively these instruments question the systems of value creation, and the blurriness surrounding originality. Multiple systems are considered: spot prices (the constantly shifting values of copper, nickel, and tin on the commodities market); numismatic value (a coin collector’s valuations based on a coin’s rarity and historical importance); contractual value (a consignment, an IOU, a promise); novel value (an original versus an edition versus a copy); and retail value (the number on a price tag), amongst others. His interrogations of these orders of value take the form of material interventions, such as a nineteenth-century ormolu vase displaying a bouquet with gentian (a French flower used as a barometer for bitterness); and a surmoulage (an unauthorized cast of an original authorized casting) of Rodin’s Definitive Study for the Head of Balzac, 1897 with the casting sprues still attached to the work.

Both in concert and in conflict, the objects within Instruments gesture to cracks and circularities within the logic of value.

-Octagon + eyes never sleep

Presented as both an exhibition of artworks and as a book that compiles original writing and archival images, Instruments represents Cooper Campbell’s research into the practice of valuation. In tandem with the release of the book, the exhibition takes place at eyes never sleep, an apartment exhibition space on the Upper East Side of Manhattan founded by Colin Ross, an associate director at a gallery on Madison Avenue. The decision to situate Instruments in an art dealer’s home was an intentional one; Campbell has embedded these works within Ross’s domestic space to invoke an appraisal of the art industry’s participants themselves.

The title Instruments is derived from the term’s financial definition: monetary contracts between parties that can be created, traded, modified, and settled. Campbell’s interests in the monetization of art have urged him to examine the art market’s role in the accumulation of wealth. An analogy to alchemy is present in Campbell’s research—what is the definition of value, and how does one issue, institutionalize, or otherwise invent value from raw material alone?

Within the contemporary art world, creating a limited edition of a replicable art object is a widely accepted practice. The sales structure of nineteenth-century French Modernist Auguste Rodin’s artworks set a legal, financial, and cultural model for dispersing the concept of an original work of art, a precedent that remains a fundamental component to today’s art industry. After Rodin’s death in 1917, the French government inherited his intellectual property rights, formed Musée Rodin as a governing body of his estate, and began to posthumously produce Rodin’s sculptures in editions of twelve. By implementing traditional casting and scaling methods to replicate the same object in multiples, it became possible to profit numerous times from the sale of what was, in essence, the same artwork. Mid-century financiers were particularly passionate about collecting Rodin’s works, and Campbell’s essay illuminates unmistakable parallels between Rodin’s market structure and the world of securities trading. In tracing this contour, Campbell finds both markets to be realms impacted, commingled, and determined behind the scenes by the influence of singular individuals and private third parties.

To illustrate the phenomenon of valuation, Campbell has rendered disparate financial devices as his own artworks. Collectively these instruments question the systems of value creation, and the blurriness surrounding originality. Multiple systems are considered: spot prices (the constantly shifting values of copper, nickel, and tin on the commodities market); numismatic value (a coin collector’s valuations based on a coin’s rarity and historical importance); contractual value (a consignment, an IOU, a promise); novel value (an original versus an edition versus a copy); and retail value (the number on a price tag), amongst others. His interrogations of these orders of value take the form of material interventions, such as a nineteenth-century ormolu vase displaying a bouquet with gentian (a French flower used as a barometer for bitterness); and a surmoulage (an unauthorized cast of an original authorized casting) of Rodin’s Definitive Study for the Head of Balzac, 1897 with the casting sprues still attached to the work.

Both in concert and in conflict, the objects within Instruments gesture to cracks and circularities within the logic of value.

-Octagon + eyes never sleep